eFNOL: make FNOL the absolute first thing that happens after a car accident

When an unforeseen event occurs in traffic, and it is covered by an insurance policy, the policyholder or the affected party must inform their insurance company promptly. This is how the world of insurance works. This notification marks the beginning of the claims process. In the industry, we call this First Notification of Loss (FNOL). The purpose of FNOL is to alert the insurer about the incident, enabling them to start evaluating the claim and initiating necessary actions for resolution. As with many things in life, with FNOL speed is of the essence. Enter: eFNOL.

The FNOL process usually involves providing essential details about the incident, such as the time, location, nature of the damage or loss, and any relevant information requested by the insurer. This information helps the insurer understand the circumstances surrounding the claim and assess its validity.

As we mentioned earlier, the timely reporting of a loss through FNOL is critical. It allows the insurance company to:

- Initiate claim handling:

It enables the insurer to start the claims handling process promptly, assigning resources and initiating investigations if necessary. - Evaluate the claim:

Reviewing the details provided helps insurers assess the situation and determine if it falls within the coverage outlined in the policy. - Prevent further loss:

Immediate notification can help mitigate additional damage or loss by providing guidance on necessary actions to the policyholder.

Streamlining FNOL: a no-brainer for every insurer

It's easy to see that FNOL serves as the crucial initial step in the insurance claim process. It enables insurers to gather essential information, assess the situation, and take necessary actions to expedite the claim settlement process for their policyholders. Therefore, First Notification of Loss (FNOL) and getting it right the first time holds immense value for insurers. We''ll list a few reasons why streamlining FNOL should be on the top of any insurers' to-do list:

- Customer service excellence:

A streamlined FNOL process enhances customer service. Prompt acknowledgment and efficient handling of claims after notification contribute to a positive customer experience, improving retention rates. - Risk assessment and management:

FNOL provides insurers with immediate information about potential claims, allowing them to assess and manage risks effectively. Understanding the nature, frequency, and severity of reported losses aids in evaluating overall risk exposure. - Fraud prevention:

Early reporting through FNOL helps in detecting potential fraudulent claims. Insurers can scrutinize details provided at the time of loss notification, compare them with policy terms, and investigate any inconsistencies or red flags. - Prompt claims processing:

Timely FNOL allows insurers to initiate the claim process swiftly. It helps in assigning resources, conducting investigations (if necessary), and expediting settlements, ultimately leading to better customer satisfaction. - Mitigation of losses:

Knowledge of losses early on allows insurers to take measures to mitigate further damage. For instance, in the case of property damage, insurers might advise on immediate actions to prevent additional losses. - Reserving and financial planning:

Insurers use FNOL data to estimate potential claim costs, enabling them to set aside adequate reserves and plan their finances effectively. This helps in maintaining financial stability and ensuring they can cover incurred losses. - Compliance and reporting:

Insurers often have regulatory obligations to report and manage claims within certain time frames. FNOL facilitates adherence to these regulatory requirements by initiating the claims handling process promptly. - Data analysis and improvement:

FNOL data forms part of insurers' analytics. They analyze these data sets to identify patterns, trends, and areas for improvement in their policies, processes, and risk assessments. - Cost control:

Early notification allows insurers to control costs associated with claims settlements. Timely interventions, accurate assessments, and efficient processing can help contain expenses. - Preventing coverage disputes:

Prompt notification helps in minimizing coverage disputes. Clear and immediate communication regarding the loss details reduces the likelihood of disagreements between the insured and the insurer regarding coverage terms.

FNOL automation: the gateway to success is called eFNOL

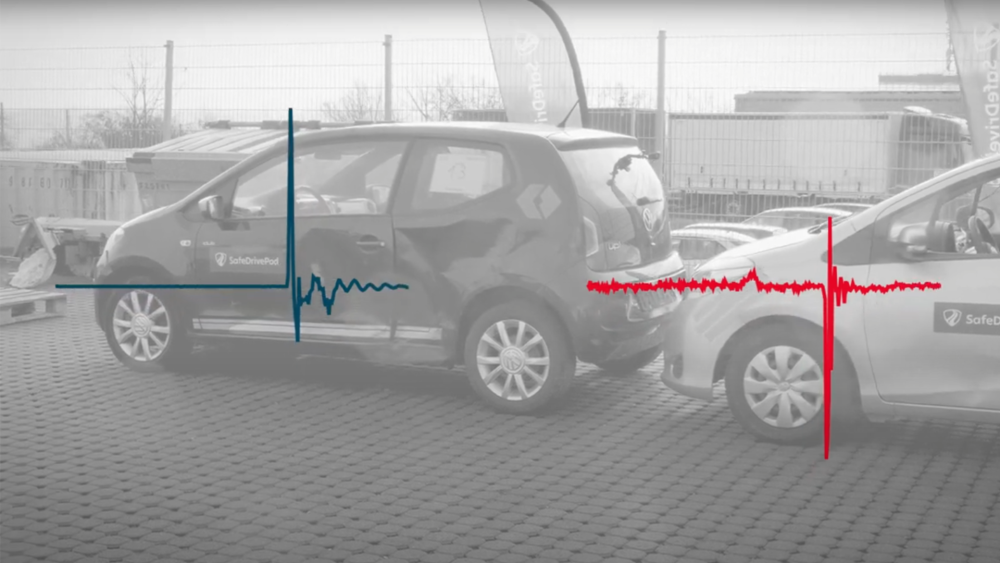

In essence, FNOL serves as the gateway for insurers to promptly address and manage risks, ensuring effective claim handling, fraud prevention, financial stability, and enhanced customer satisfaction. The next step in further optimising FNOL is automation, or eFNOL. By employing a crash detection system like SafeDriveResponse and exporting telematics data (captured by SafeDriveMotion) of the vehicle leading up to the incident - and even of the incident itself - FNOL as an initial and crucial step in claims handling is elevated to another level completely.

Automating First Notification of Loss (eFNOL) offers several advantages for insurers:

- Enhanced customer experience:

A smooth, automated FNOL process provides a better customer experience. It offers convenience, quicker resolution, and transparency, contributing to higher customer satisfaction and retention rates. - Immediate response:

Automated FNOL systems can provide immediate acknowledgment of receipt of the claim, reassuring the policyholder that their claim is being processed. This quick response enhances customer satisfaction and reduces anxiety about the status of their claim. - Efficiency and speed:

eFNOL streamlines the entire process, reducing the time taken to receive and process claims. Automated systems can instantly capture and record details, eliminating manual data entry and minimizing delays in claim handling. - Mitigation of human error:

FNOL automation reduces the likelihood of human errors in recording or transcribing information. Consistency in data entry and processing helps ensure accuracy throughout the claims process. - Fraud detection:

eFNOL can use algorithms and analytics to detect potential fraud patterns or discrepancies in reported information. Early detection helps insurers investigate suspicious claims promptly, reducing fraudulent payouts. - Cost savings:

By reducing manual intervention and improving efficiency, eFNOL leads to cost savings for insurers. It streamlines operations, minimizes administrative costs, and allows staff to focus on more complex claim issues that require human judgment. - Extensive data analytics and automated insights:

Automated FNOL systems generate data that insurers can analyze to identify trends, patterns, and areas for improvement. This data-driven approach helps in refining risk assessments, enhancing product offerings, and optimizing claim processes. - Consistency in processing:

FNOL automation ensures a consistent approach to handling claims, following predefined protocols and procedures. This consistency reduces variability in claim outcomes and ensures adherence to regulatory requirements. - Scalability:

eFNOL allows insurers to handle a higher volume of claims without significantly increasing their operational costs. It provides scalability to manage fluctuations in claim volumes efficiently.

Embrace the unrelenting power of eFNOL

Most real world implementations of automated FNOL currently are still in it's early stages. The adoption rate is quite slow, there are no fast movers in the industry, whilst policyholders are more than ready for it. That's why we can expect to see great leaps the coming years. Also, the rise of AI and large language models gives us a promising look into the future of insurance and risk management.

The future of eFNOL is now

At SafeDrivePod, we're making that future happen right now. Combining the right hardware and software is key to automating FNOL processes. Together with world renowned parties and thought leaders who also like to break the mold in meaningful ways, we're implementing automated FNOL as we speak. We're enabling insurers to improve efficiency, accuracy, fraud detection, and customer experience while reducing operational costs. It's a strategic move that not only benefits insurers but also enhances the overall claim handling process for policyholders.

Want to join in on the eFNOL fun?

Be sure to contact us, and we'll gladly tell you everything about it and what eFNOL could mean for your business.